How to Properly Calculate EBITDA for Improved Financial Insights in 2025

Calculating EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is an essential aspect of financial analysis in 2025. This key metric helps businesses understand their overall profitability and operational efficiency while facilitating investment decisions and company valuations. In this article, we will provide a comprehensive guide on how to calculate EBITDA, discuss the EBITDA formula, and explore its importance in various financial contexts.

Understanding EBITDA and Its Significance

Understanding EBITDA is critical for anyone interested in financial performance indicators. EBITDA offers a clearer picture of a company’s operational profitability, stripping away the effects of financing and accounting decisions. It enables investors, analysts, and business owners to benchmark performance against peers in the industry. One of the unique aspects of EBITDA is its relevance across different sectors, which allows for standardized comparisons.

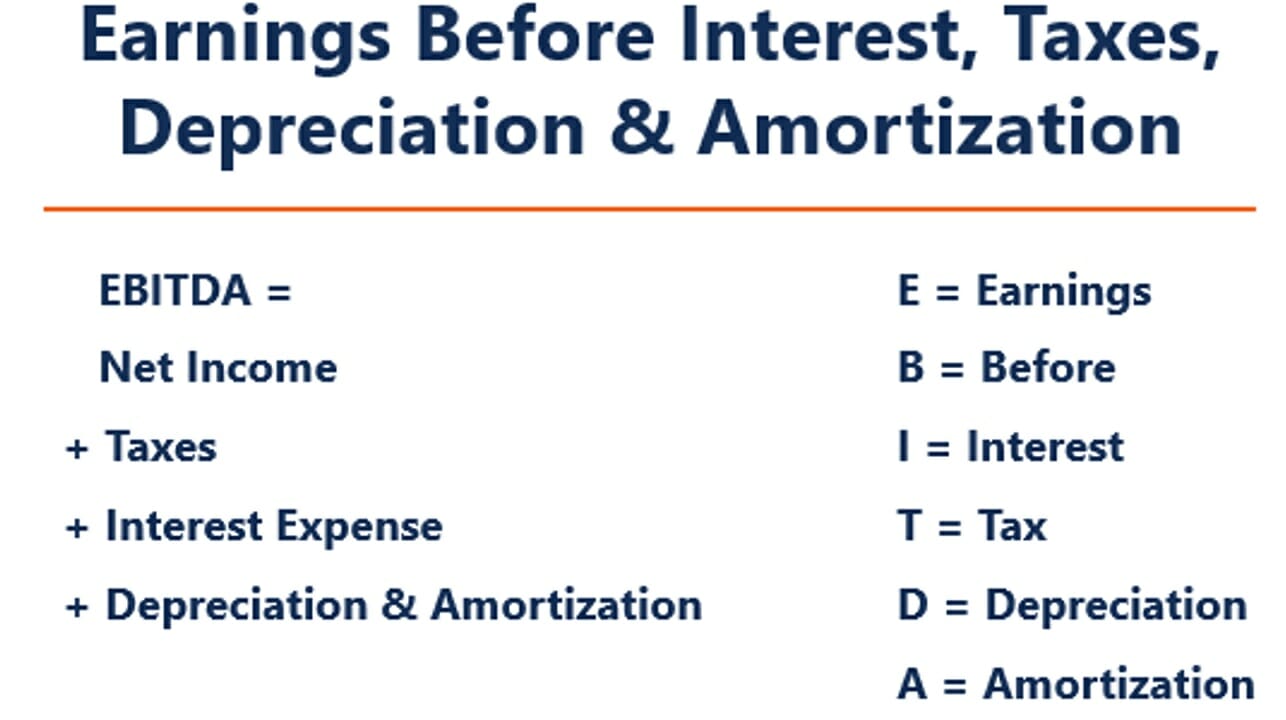

EBITDA Definition and Components

The EBITDA definition combines multiple components to provide valuable insights into a company’s earnings power. Specifically, the EBITDA calculation typically follows this formula: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization. Each component sheds light on various aspects of a company’s financial standing. For example, removing depreciation and amortization expenses gives a more accurate representation of cash generated from operations, excluding the impact of investment decisions and non-cash items.

EBITDA Importance for Financial Analysis

The EBITDA importance in finance cannot be overstated. This metric serves various purposes, especially in valuation, as it helps investors gauge a company’s cash flow generation potential. Moreover, analyzing EBITDA over time can reveal trends in performance, highlighting companies with high EBITDA as potential investment opportunities. Additionally, various industries employ EBITDA margins to compare profitability effectively.

Advantages and Limitations of EBITDA

While EBITDA is a valuable tool, it’s essential to recognize both its advantages and limitations. On one hand, the advantages of EBITDA include offering insights into operational performance without the distortion of capital structures and tax strategies. However, limitations of EBITDA include that it does not account for changes in working capital, and it ignores capital expenditures. As a result, analysts should use EBITDA in conjunction with other metrics to achieve a comprehensive financial analysis.

Calculating EBITDA Step by Step

Knowing how to calculate EBITDA effectively can empower businesses to derive actionable insights from their financial data. Let’s break down the EBITDA calculation into simple steps for clarity.

EBITDA Calculation Methods

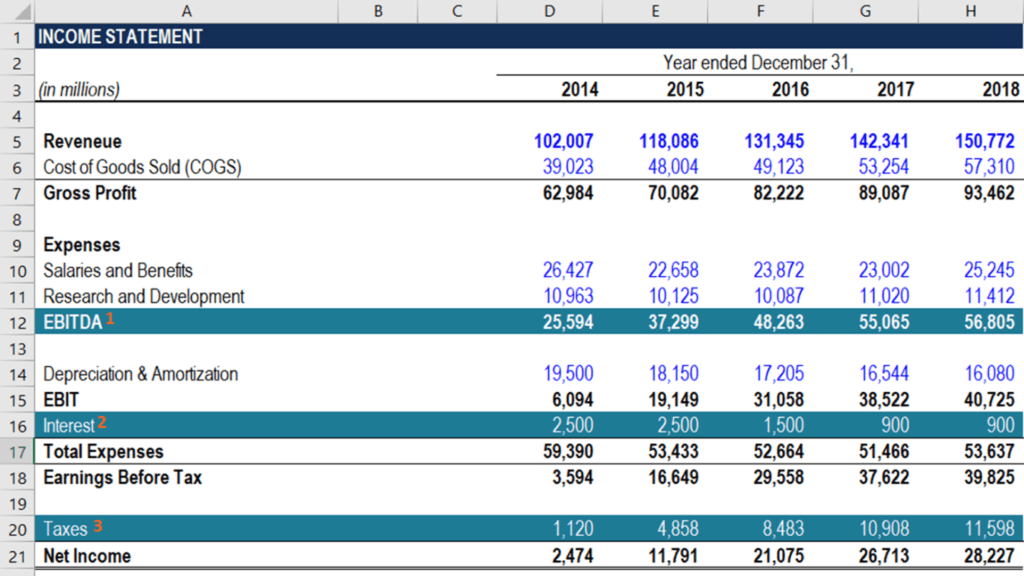

There are primarily two methods of EBITDA calculation: direct and indirect. The direct method calculates EBITDA from raw revenue figures, whereas the indirect method begins with net income. To calculate using the indirect method, follow these steps:

- Start with net income from the income statement.

- Add back the interest expenses to the net income.

- Add the tax expenses.

- Finally, include depreciation and amortization expenses to get EBITDA.

This structured approach helps ensure accurate results and consistency while performing calculating EBITDA step by step.

EBITDA Adjustments for Accuracy

It is common to encounter items that may affect the core EBITDA figure significantly. In such cases, EBITDA adjustments are essential for accuracy. Typical adjustments include depreciation, amortization, and non-recurring items such as gains from asset sales or losses from legal settlements. A proper understanding of these EBITDA adjustments for non-recurring items is vital for obtaining a normalized EBITDA value that reflects ongoing business operations.

Using Excel for EBITDA Calculations

For many aspiring financial analysts, performing EBITDA calculations in Excel can streamline the process. To simplify, users can create a spreadsheet with formulas that automatically calculate EBITDA based on input data such as revenue and expenses. Utilizing templates or making use of existing financial models ensures accuracy while saving time—perfect for thorough EBITDA analysis techniques.

EBITDA in Investment Analysis

Understanding the relevance of EBITDA in investment contexts helps inform one’s approach towards stock valuation and performance assessment. EBITDA in investment analysis provides insights into the operational performance of a company, aiding in identifying suitable investment opportunities.

EBITDA vs. Net Income

One of the critical comparisons analysts make is between EBITDA vs. net income. While net income accounts for all expenses, EBITDA focuses on earnings before specific deductions, providing clearer insight into operational efficiency. This comparative analysis enables stakeholders to adjust their assessments based on a business’s operational robustness, setting clearer expectations regarding performance sustainability.

EBITDA for Business Valuation

Using EBITDA for valuation involves calculating multiple valuation multiples, known as EBITDA multiples. Investors use these multiples to compare businesses within the same industry, evaluating whether a company’s stock is overvalued or undervalued based on its expected cash flows. Furthermore, when conducting mergers or acquisitions, potential buyers heavily rely on EBITDA for valuation to make informed offers.

EBITDA Growth Rate and Forecast

Evaluating the EBITDA growth rate in the context of market trends and competitive positioning provides insights into a company’s future performance potential. Investors often assess historical EBITDA growth rates to project future growth and gauge ongoing capital investment needs. This emphasis on EBITDA forecast enables the development of comprehensive financial strategies.

Key Takeaways

- EBITDA is a fundamental financial metric that enhances understanding of operational performance.

- Accurate calculations, including adjustments for non-recurring items, are crucial for meaningful analysis.

- Comparative assessments with net income and EBITDA multiples enable informed investment decisions.

- Excel can simplify complex EBITDA calculations and facilitate effective financial modeling.

FAQ

1. What is the EBITDA formula?

The EBITDA formula is simple: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization. This formula highlights key components that collectively indicate a company’s operational profitability.

2. What is the importance of EBITDA in financial analysis?

Understanding the importance of EBITDA lies in its capacity to provide insights into cash-generating operations, simplifying comparisons across revenue models and industry benchmarks.

3. How do I adjust EBITDA for non-recurring items?

When performing EBITDA adjustments for non-recurring items, it’s essential to identify and exclude income or expenses that won’t continue in the future, offering a clearer view of normalized operational performance.

4. Can I calculate EBITDA using Excel?

Yes, calculating EBITDA in Excel is straightforward. Users can create a spreadsheet with formulas to automate EBITDA calculations based on financial data inputs, simplifying the process while maintaining accuracy.

5. What are the common limitations of EBITDA?

While useful, limitations of EBITDA include its failure to account for debt obligations, capital expenditures, and working capital changes, making it vital to utilize alongside other metrics for a comprehensive analysis.

6. How is EBITDA used in investment analysis?

In investment analysis, EBITDA serves as a measure to assess a company’s operational performance, helping investors determine valuation metrics and evaluate potential investment opportunities against financial benchmarks.

7. When should EBITDA be used over net income?

Investors and analysts should consider using EBITDA vs net income when evaluating operational efficiency without the complexity of depreciation, amortization, and tax structures, providing a more focused financial view.