“`html

Essential Guide to How to Send Money on Cash App in 2025

In today’s fast-paced world, knowing how to send money on Cash App efficiently is essential. This guide will help you navigate the complexities of sending and managing money using the Cash App platform. Whether you’re using it for personal transactions or business-related payments, understanding the nuances of the Cash App transfer process will enhance your experience.

Getting Started with Cash App

To effectively use the Cash App for money transfers, you first need to set up your account. The Cash App setup is simple and user-friendly, making it accessible for everyone. After downloading the app, you’ll need to provide your mobile number or email address. Next, you can link your bank account, debit card, or use your Cash App balance for transactions. Verifying your account ensures a secure platform for your Cash App payments.

Connecting Your Bank Account to Cash App

A critical step when utilizing Cash App money management is linking your bank account. To connect, open the app and navigate to the “Banking” tab. Here, you’ll find the option to add a bank account. Once linked, you can easily transfer funds. This connectivity allows for seamless transactions, whether you’re sending money via Cash App or receiving funds from others. Remember that you’ll need to verify your bank account, which typically involves confirming small test deposits.

Using Cash App Internationally

Another advantage of Cash App is its potential for using Cash App internationally. While there are limitations, it’s essential to be aware of how to send money effectively across borders. Users must check if the recipient’s Cash App account is compatible with international transactions. Diversifying your payment options can make sending funds easier, especially when dealing with third-party payments.

Understanding Cash App Payment Options

Cash App offers various payment options to cater to different user needs. From instant bank transfers to utilizing the Cash App Visa card, there are multiple ways to send cash. In under a minute, users can execute a transaction, making Cash App a top choice among mobile payment apps. Understanding each option will allow you to choose the best method for your transaction needs.

Cash App Fees and Transaction Limits

Before you begin transferring funds via Cash App, it’s crucial to understand the associated fees and limits. Cash App generally imposes fees for instant transfers to your bank account but offers free standard transfers. Be aware of the Cash App transaction limits, which can vary depending on your verification status. New users start with lower limits, but these can increase as you establish your account and verify your identity.

Cash App Notifications and Transaction History

Monitoring your Cash App transaction history is vital for keeping track of your spending and ensuring security. Cash App provides detailed history logs, which makes it easy to account for every transaction. It also sends notifications for every payment, keeping you informed and alert to fraudulent activities.

Best Practices for Using Cash App

Employing the best practices will ensure a secure and efficient experience while using Cash App for payments. Start by enabling Cash App security features like two-factor authentication to safeguard your account. Regularly review your Cash App notifications to stay aware of any unusual transactions. Lastly, take the time to familiarize yourself with the app’s features to maximize its benefits.

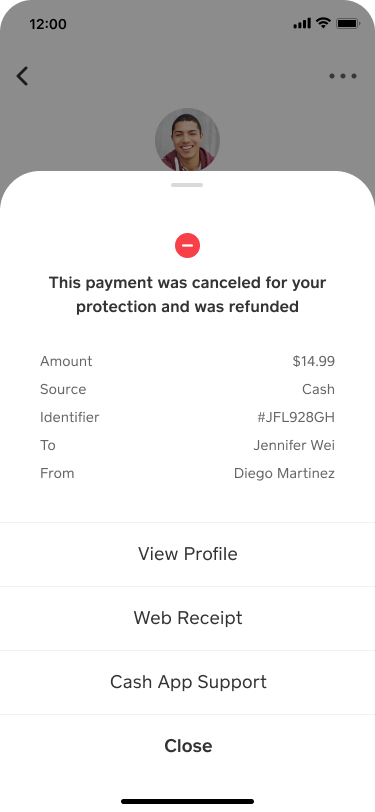

Troubleshooting Cash App Transfers

Sometimes users encounter issues when sending money. Understanding common issues can streamline your experience. If a payment fails, check your internet connection or ensure the recipient’s account is active. Cash App also has a support section which can be very helpful for troubleshooting. Additionally, consider Cash App customer support for real-time assistance.

Managing Your Cash App Account Effectively

Regularly managing your account is vital for effective use. This entails reviewing your settings, updating your payment preferences, and checking for recent Cash App updates. Syncing your account preferences with your transaction habits fosters more efficient financial management. Take advantage of Cash App’s budgeting tools for improving your monetary tracking.

Key Takeaways

- Understand how to send money on Cash App by setting up your account and linking your bank account.

- Explore different Cash App payment options, including the use of the Cash App Visa card.

- Be aware of Cash App fees and transaction limits to manage your finances wisely.

- Implement best practices like security features and account monitoring to enhance safety.

- Seek customer support or consult FAQs for troubleshooting steps when issues arise.

FAQ

1. What should I do if a Cash App payment fails?

If a Cash App payment fails, first check your internet connection. Ensure that the recipient’s Cash App account is active. If problems persist, consult Cash App customer support for further assistance.

2. Can I use Cash App for international payments?

Yes, you can use Cash App for international payments, but you must verify if the recipient’s account supports receiving international transactions. Some restrictions may apply based on geographic locations.

3. What is the fee for transferring money on Cash App?

Cash App imposes fees for instant bank transfers. Standard bank transfers remain free. Always check your transaction details for any applicable fees when sending cash through the app.

4. How can I enhance security on my Cash App account?

To enhance security on Cash App, enable two-factor authentication and keep your app updated. Regularly monitor your transaction history for any unauthorized activities.

5. What features does Cash App offer for personal budgeting?

Cash App has various features for personal budgeting, including tracking your transaction history and setting spending limits. Familiarizing yourself with these features can improve your financial management.

“`