“`html

Effective Methods to Calculate Revenue in 2025 – Understand Key Insights!

Understanding Revenue Calculation

Calculating revenue accurately is crucial for any business strategy. By effectively utilizing various revenue calculation methods, companies can gain insights into their overall financial health and operational performance. When discussing how to calculate revenue, it’s essential to consider different revenue streams, such as direct sales, subscriptions, and service fees. Understanding how these sources contribute to the total revenue allows for deeper insights into present and future revenue growth.

Challenges in Revenue Forecasting

One common challenge in the realm of revenue management is accurately predicting revenue trends based on market fluctuations and business dynamics. Effective revenue forecasting requires the use of historical data to project future sales accurately. By applying consistent analysis methods, companies can address potential challenges by adapting their strategies to meet revenue goals.

Essential Revenue Metrics

Tracking various revenue metrics is vital for determining business efficiency and sustainability. Key metrics include gross revenue, net revenue, and operating revenue. Understanding these revenue drivers helps businesses refine their operations and enhance profitability through detailed profitability analysis.

Applying Revenue Calculation Techniques

There are several methods to calculate revenue. Firstly, the simplest technique involves summing up total sales revenue within a specific period. However, more advanced methods such as revenue optimization leverage data analytics to improve revenue performance. Companies must adapt both traditional and contemporary revenue calculation methods to generate accurate assessments and facilitate concrete business planning.

Revenue Growth Strategies for 2025

As businesses advance towards 2025, implementing robust revenue growth strategies will be critical. This will involve not only enhancing existing revenue streams but also identifying new avenues for revenue generation. It’s essential to have a clear plan for tackling market competition and addressing customer demands effectively.

Improving Revenue through Diversification

Diversifying your revenue sources can significantly impact your bottom line. This entails expanding product lines or adding new services. By doing so, businesses can mitigate risks associated with over-relying on a single source of income. For example, a tech company venturing into software subscriptions has the potential to enhance business revenue and maintain sustained revenue growth.

Utilizing Revenue Forecasting Tools

Employing advanced forecasting tools can provide substantial insight for revenue planning. Various software solutions help in analyzing revenue performance, thereby enabling decision-makers to analyze sales and customer trends. Utilizing these financial analysis revenue tools provides a clearer view of projected profits, ensuring that the revenue projections align with market expectations.

Engaging in Revenue Improvement Practices

To achieve substantial improvements, businesses must continually analyze their revenue metrics. Strategies such as optimizing pricing and reviewing revenue management processes can result in immediate enhancements in overall revenue. For instance, implementing tiered pricing strategies may lead to increased customer acquisition and retention, ultimately influencing your financial revenue positively.

Utilizing Revenue Reporting Solutions

Effective revenue reporting solutions provide comprehensive insights into how well revenue strategies are performing. These reports include detailed revenue analyses that help identify patterns and provide a clear picture of financial health.

Generating Comprehensive Revenue Reports

Generating a revenue report should encompass various aspects of the business. Ensuring it analyzes all facets of business revenue directs attention to current performance levels, while highlighting opportunities for improvement as well as areas needing attention. Such analysis reinforces the connection between revenue and profitability through clear visibility.

Implementing Revenue Metrics Analysis

Evaluating revenue trends through various metrics allows businesses to understand operational efficiency better. Critical metrics such as customer retention rates, sales conversion rates, and profit revenue ratios are essential indicators of a business’s ability to optimize its revenue cycle. By tracking these metrics regularly, companies can make informed adjustments that enhance revenue growth.

Creating a Revenue Dashboard

Integrating a comprehensive revenue dashboard simplifies tracking various revenue sources. Additionally, such dashboards can visualize critical revenue metrics, offering strategic insights that enable businesses to adjust quickly to any fluctuations. Whether through automated reporting tools or custom solutions, dashboards provide critical data that can inform key business decisions.

Key Insights for Future Revenue Planning

As 2025 approaches, understanding key insights for effective revenue planning becomes crucial. Companies must stay attuned to market changes and leverage revenue analytics tools to predict trends accurately. In this way, they can align their strategies to meet anticipated customer demands and maintain competitiveness in rapidly evolving markets.

Adopting Advanced Revenue Techniques

Adopting advanced techniques for calculating revenue ensures that businesses stay ahead of the curve. Integrating technology such as artificial intelligence in revenue forecasting can yield greater precision and foresight. For instance, using predictive modeling helps in refining revenue reports, allowing organizations to make informed decisions rooted in calculated projections.

Fostering Collaboration Across Revenue Operations

Collaborating across revenue operations enhances the effectiveness of strategies employed. A synergistic approach that includes sales, finance, and marketing helps align all teams towards common revenue goals, fostering collective effort. This can lead to not only achieving but exceeding set revenue targets.

Tracking Revenue Impact on Business Strategies

Monitoring the impact of revenue on broader business strategies is key to sustaining growth. Constantly assessing different revenue benchmarks and aligning them with strategic objectives provides a roadmap for improvements. Adopting a systematic approach to revenue trends assists in evaluating overall financial health and leveraging growth opportunities effectively.

Key Takeaways

- Understanding various revenue calculation methods is essential for accurate financial forecasting.

- Diversifying revenue streams minimizes risk and enhances profitability.

- Effective revenue reporting through advanced analytics ensures clarity in planning.

- Collaboration across revenue operations aligns teams and maximizes revenue efforts.

- Tracking revenue metrics is key to sustained growth and strategic success.

FAQ

1. What is the best method to calculate revenue growth?

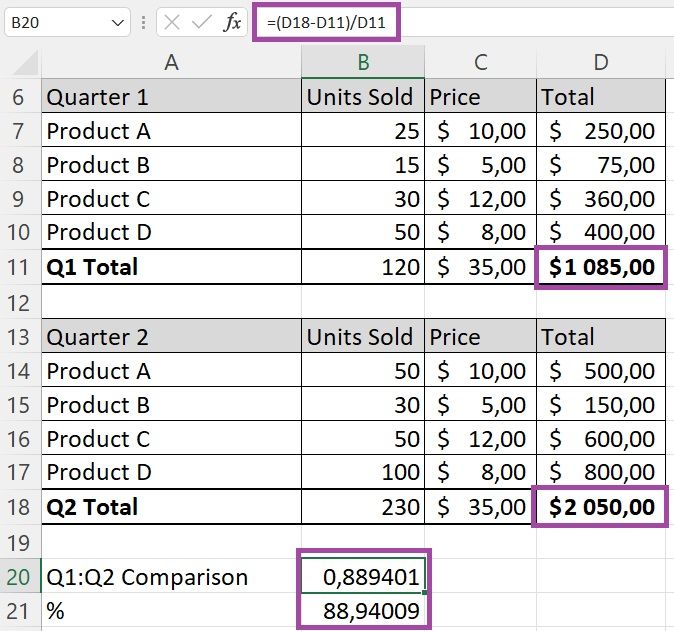

The best method to calculate revenue growth involves comparing the current period’s revenue to a previous one, typically expressed as a percentage increase. This allows businesses to identify growth trends and adjust strategies accordingly.

2. How can I enhance my revenue model?

To enhance your revenue model, consider diversifying your sources of income, optimizing pricing strategies, and leveraging data analytics to spot emerging trends that can drive additional revenue.

3. What are common revenue reporting solutions?

Common revenue reporting solutions include financial dashboards, automated reporting tools, and analytical software that integrate sales data to provide actionable insights for decision-making.

4. How do revenue metrics impact financial decision-making?

Revenue metrics provide critical insights that shape financial decision-making. By analyzing these metrics, organizations can identify inefficiencies, optimize pricing strategies, and enhance customer acquisition efforts.

5. What is the difference between revenue and profit?

The difference between revenue and profit lies in the fact that revenue represents the total income generated from sales, while profit is revenue minus expenses, encompassing a company’s financial health and sustainability.

“`