Effective Ways to Become an Actuary in 2025: Essential Insights and Tips

Understanding the Actuarial Profession

The **actuarial profession** is a unique and growing landscape that combines **mathematics for actuaries**, **statistics**, and financial theory to analyze future risks. It plays a crucial role in various industries, such as insurance, healthcare, finance, and beyond. Understanding what it means to be an actuary requires knowledge of the **skills required to be an actuary**, along with professional responsibilities that potentially shape one’s entire career. Moreover, the process begins with obtaining **actuarial education** and understanding the different types of **actuarial disciplines** based on your interest and career aspirations.

Key Roles and Responsibilities of Actuaries

Actuaries hold vital roles in organizations by applying **statistical analysis** and predictive modeling to assess, manage, and minimize future risks. Among their main **actuarial responsibilities** are creating financial models, conducting trend analysis, and developing strategies to ensure sound risk management. Additionally, many actuaries work with **insurance policies** and need to understand **compliance regulations** relevant to the industry they serve. Those pursuing a **career in actuarial science** must be ready to take on such responsibilities, ensuring ethical standards are maintained while navigating complex challenges.

The Importance of Actuarial Associations

Joining **actuarial associations** is a strategic move for aspiring actuaries. These organizations provide immense support in professional development and networking, enabling individuals to connect with mentors in the field. Networking within the **actuarial community** can also lead to job opportunities and collaborations on various projects that foster continuous improvement in actuarial practices. Associations often hold conferences, provide access to **actuarial exam study materials**, and offer workshops that can enhance **skills required to be an actuary**.

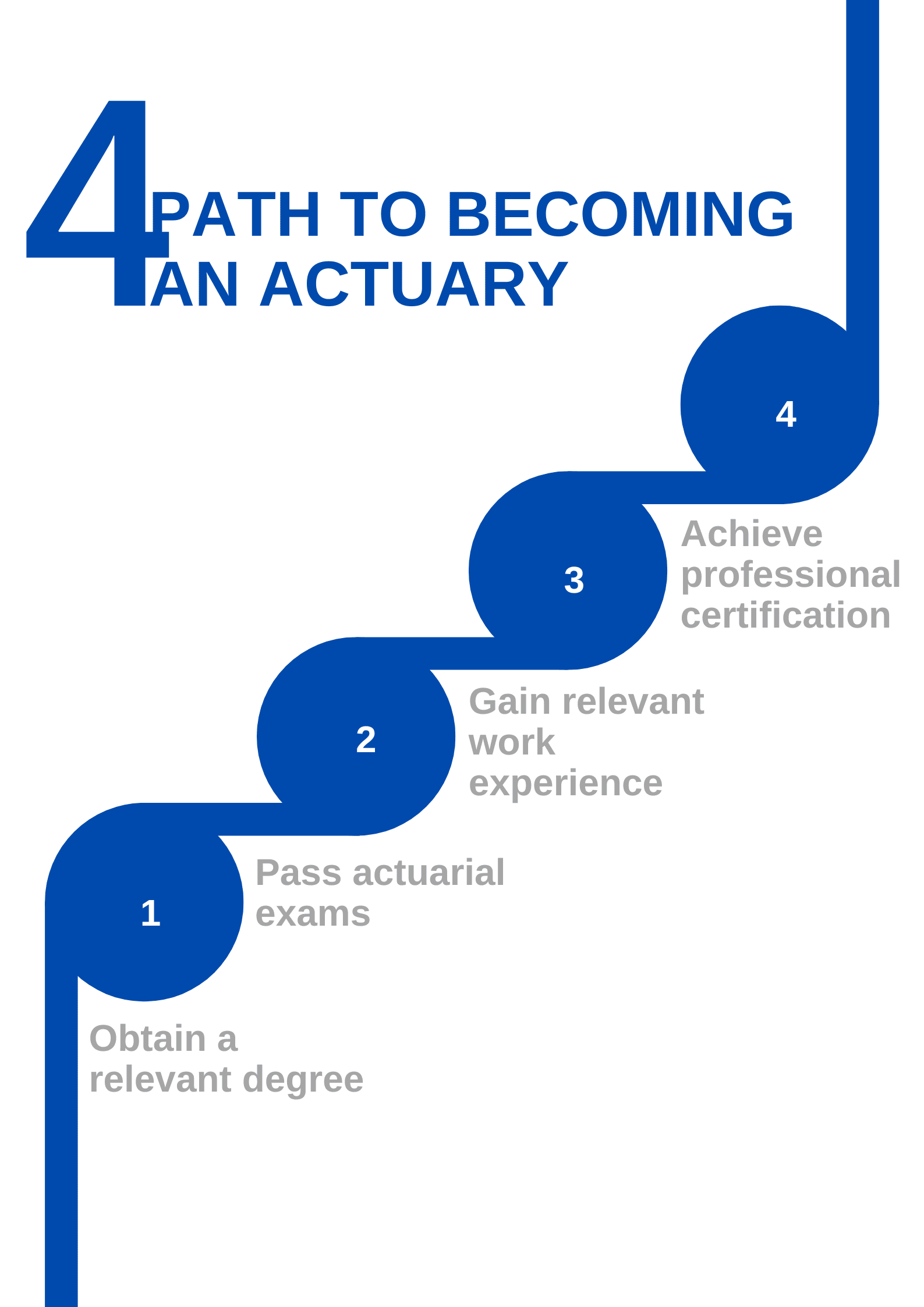

Steps to Become an Actuary in 2025

For individuals interested in finding out **how to become an actuary**, the journey begins with education and preparation. In 2025, the steps to pursuing this rewarding career typically include a bachelor’s degree, passing **actuarial exams**, gaining practical experience through **actuarial internships**, and certification through recognized organizations.

Educational Pathways to Actuarial Science

A strong educational foundation in mathematics, statistics, and finance is essential to succeed in a **career in actuarial science**. Pursuing a degree related to **actuarial studies** or related disciplines opens doors to numerous opportunities. Many universities now offer specialized programs in **actuarial science**, which provide critical insight into both the theory and practical applications needed in this field. Adding complementary subjects, such as data analysis and financial management, can further enhance one’s knowledge base.

Preparing for Actuarial Exams

**Actuarial exams** are a significant hurdle in the journey to professional designation. To succeed, individuals should form a solid study plan, focusing on core subjects such as **probability**, **financial mathematics**, and **actuarial models**. Utilizing reliable **exam prep** tools, joining study groups, and referring to resources from actual **actuarial organizations** can significantly boost exam performance. Equipping oneself with learning strategies tailored to your style of studying will promote an effective examination experience as you move towards your certification goals.

Gaining Experience through Internships

Obtaining an **actuarial internship** can provide practical experience, making candidates significantly more attractive to employers when seeking entry-level positions. During internships, students can gain exposure to real-world problems, utilize relevant **actuarial software**, and often participate in **actuarial projects** that reinforce their academic knowledge. These internship opportunities not only enhance a resume but also help intern candidates build invaluable connections in the actuarial field.

Building Your Career in Actuarial Science

Your career advancement in the **occupational landscape** of peuter actuary roles relies heavily on practical experience, professional development, and continued learning about evolving actuarial practices. By laying a strong foundation early in your career, you can capitalize on various **actuarial job titles** with paths leading to higher positions in insurance, finance, and consulting services. Continuous exploration of **actuarial fields** and specializations strengthens your professional portfolio.

Advanced Actuarial Education and Certification

As an aspiring actuary, investing in advanced **actuarial education** is vital for professional growth. Pursuing higher qualifications not only deepens understanding of complex concepts like **financial risk analysis** and **risk management**, but also enhances your employability within the industry. Specialized designations, such as **Fellow of Society of Actuaries (FSA)** or **Chartered Enterprise Risk Analyst (CERA)**, can be attained through achieving relevant **actuarial qualifications**, enhancing career progression and opening doors to senior roles in top firms.

The Impact of Technology on Actuarial Work

In 2025, the actuarial profession is strongly influenced by technology. The rise of data visualization and financial modeling tools allows actuaries to analyze data effectively and deliver more meaningful insights. Familiarity with software programs such as R programming and advanced Excel techniques for **data analysis for actuaries** is paramount to remaining relevant. Understanding **how technology reshapes actuarial work** can benefit existing professionals as they adapt to new methodologies, making informed decisions, and strategically planning for clients.

Trends in the Actuarial Job Market

The **actuarial job market** continues to evolve, influenced by data advancements and changing client needs. Key trends include a growing demand for actuaries in **healthcare** and **consulting**. Furthermore, experts emphasize the increasing intersection of actuarial work with roles in finance, emphasizing that actuaries equipped with strong analytical skills and understanding of **financial services industry** insights will play a crucial role. Keeping up with market dynamics signifies the readiness to pivot and adapt, reinforcing your career goals and ensuring employability.

Key Takeaways

- Understand the crucial skills required and educational pathways to become an actuary.

- Prepare strategically for actuarial exams utilizing resources and study materials from actuarial organizations.

- Gain practical experience through internships to bolster your resume and professional network.

- Stay informed about technological advancements that shape the actuarial profession.

- Continuously invest in advanced education to remain competitive in the evolving job market.

FAQ

1. What exactly do actuaries do?

Actuaries are professionals who apply mathematical and statistical methods to assess risk, develop financial models, and guide decision-making processes in the insurance and financial sectors. Their work involves analyzing data to create projections pivotal for pricing strategies and ensuring compliance with industry regulations.

2. How long does it take to become a certified actuary?

Becoming a certified actuary typically requires a minimum of 7-10 years, including the completion of a bachelor’s degree, passing several intensive examinations offered by various actuarial organizations, and gaining relevant work experience.

3. What are some popular actuarial job titles?

Common job titles within the actuarial field include Actuarial Analyst, Risk Manager, Pension Actuary, Life Insurance Actuary, and Health Insurance Actuary, each with specific responsibilities related to their focus area.

4. Are there internship opportunities available for aspiring actuaries?

Yes, many companies offer actuarial internships that provide valuable experience in a real-world setting. These internships help students to gain practical skills and networking opportunities within the actuarial community.

5. What industries are actuaries commonly found in?

Actuaries are predominantly found in the insurance, financial services, and healthcare industries. However, their skills are adaptable and valuable in various sectors, including consulting, risk management, and government.