How to Properly Fill a Check: Essential Steps for 2025

Filling a check correctly is crucial for ensuring reliable transactions. Understanding the various components and procedures helps both personal and business check users avoid costly mistakes. In this guide, we’ll go through a comprehensive process of how to fill a check, including examples, mistakes to avoid, and key details to include, making it suitable for 2025 and beyond.

Understanding the Check Format

When considering how to fill a check, it’s essential to start with a basic understanding of the **check format**. This format varies slightly depending on whether you’re using a personal, business, or cashier’s check. Generally speaking, all checks contain several standardized components: the date, payee, amount in numbers and words, signature line, and memo section. Familiarizing yourself with these fields enables you to master the **check filling process** efficiently.

Components of a Check

A clear understanding of the components listed on a check is essential for anyone learning **how to write a check**. Typically, these include:

- The Date: Found at the top right, indicates when the check was written.

- Payee’s Name: The recipient of the payment, ideally printed clearly.

- Amount: Written both in numbers and words to prevent any confusion.

- Signature: Authorized signature of the check writer, validating the payment.

- Memo: Optional space for notes about the purpose of the check.

Being aware of these components ensures that you’re filling in a check accurately and completely.

Common Check Formats

Knowing that different types of checks present variations in formats can streamline the **check filling process**. Personal checks have a traditional layout; business checks might include branding or additional elements like invoice numbers, while electronic checks offer more digital flexibility with enhanced security features. Regardless of the check type, the core components remain consistent, offering clarity and facilitating effective transactions.

Steps to Fill in a Check

Understanding the specific **check writing steps** is imperative to avoid errors. To fill a check correctly, follow these essential steps carefully:

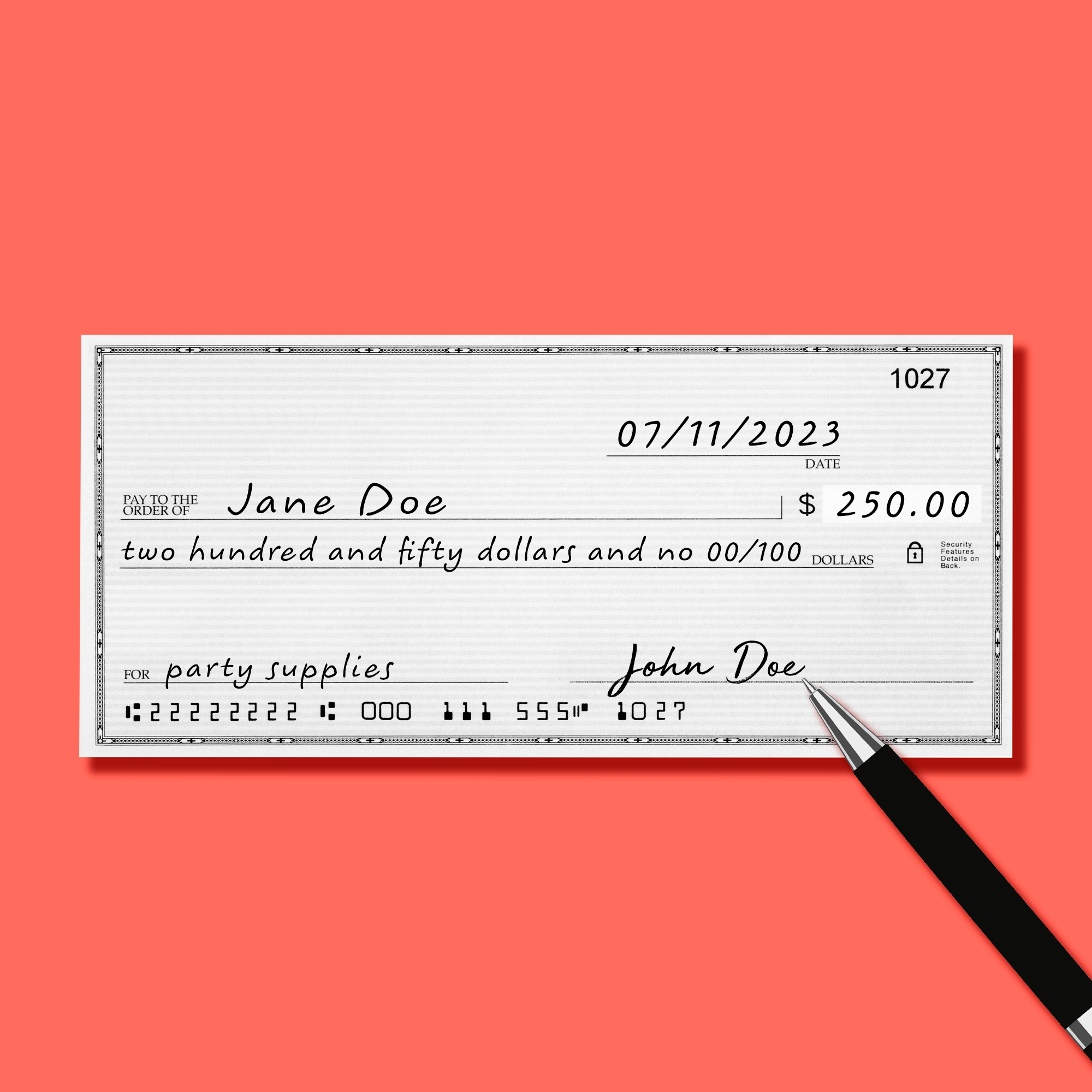

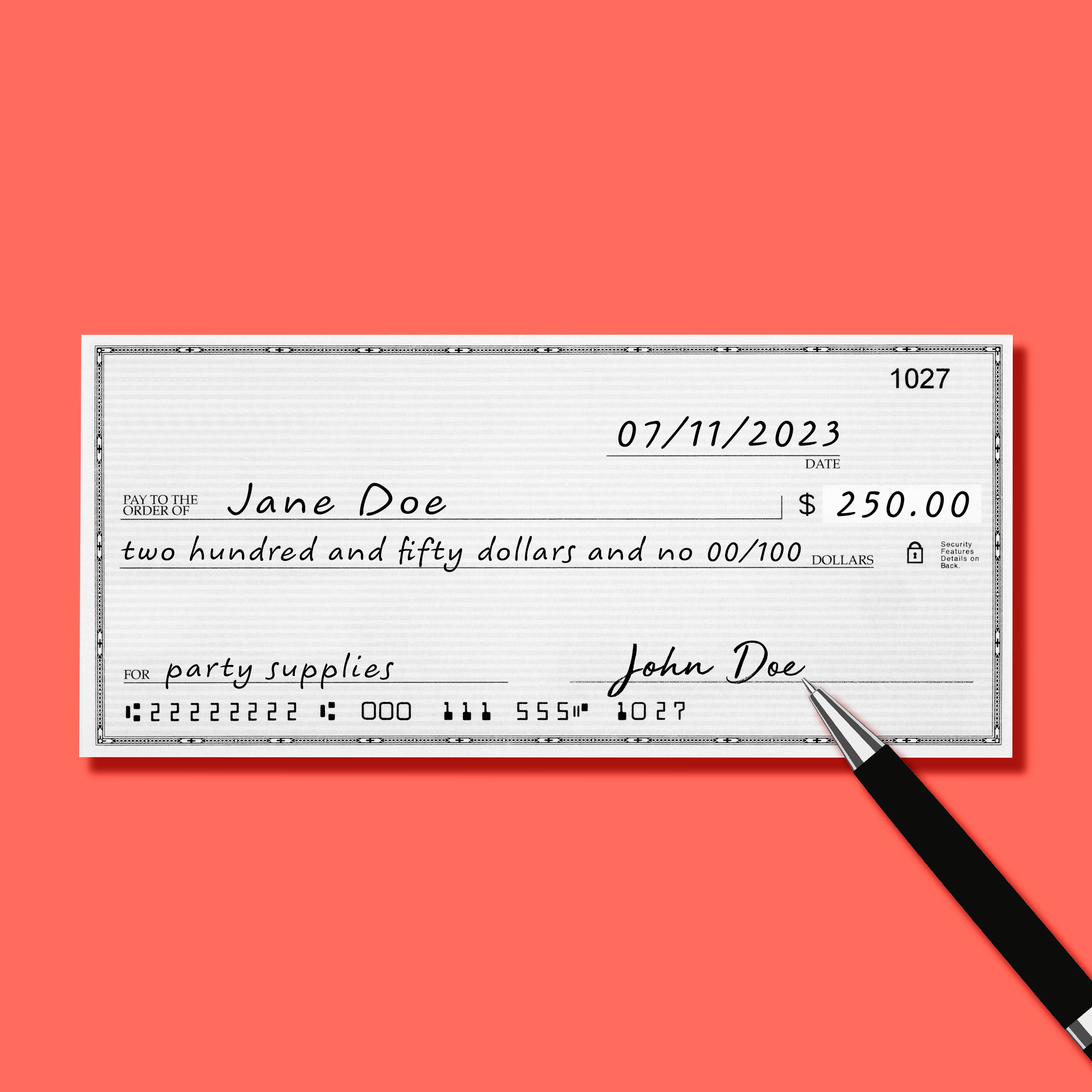

Step-by-Step Check Filling Instructions

1. **Write the Date:** Place the current date in the top right corner, using the month-day-year format.

2. **Indicate the Payee:** In the “Pay to the order of” line, clearly write the name of the person or organization you are paying.

3. **Fill in the Amount:** Write the amount numerically in the box located on the right, and in words on the line below. For example, if you are paying $150.00, you would write “One hundred fifty and 00/100.”

4. **Memo Line (Optional):** If you want to note the purpose of the check, add details here, such as “Rent” or “Services Rendered.”

5. **Sign the Check:** Sign your name on the bottom right line. Ensure your signature matches the one provided to your bank.

Filling a Check Example

To illustrate, let’s take an example of filling out a personal check for **rent payment**. If your rent is $1200, write the date, the payee’s name (your landlord), the amount both numerically and in words, the memo (“Rent for July”), and finally your signature. Following these instructions avoids common **check filling mistakes** and ensures the check is valid.

Check Filling Tips and Common Mistakes

Even with an understanding of how to fill a check, it’s common for people to make mistakes. Here are some top **check filling tips** to ensure accurate and error-free transactions.

Best Practices for Filling a Check

1. **Use Blue or Black Ink:** This prevents the potential for your check to be altered in the future.

2. **Keep Check Amounts Clear:** Avoid using decimals that may confuse the reader and verify that the numerical amount matches your written amount.

3. **Avoid White-out:** If you make a mistake, it’s best to void that check and start fresh rather than trying to correct it with white-out.

Common Check Mistakes to Avoid

While filling a check, some recurrent issues may lead to processing problems. Ensure you avoid these pitfalls:

- Not signing the check, which makes it invalid.

- Writing an incorrect or incomplete payee’s name.

- Forgeting the memo line, which can clarify the purpose of your check for both you and the payee.

Recap and Conclusion

Accurately filling out a check is a simple yet essential skill that can save you from hassles in managing finances. By following the steps outlined in this guide, reviewing **check filling instructions**, and avoiding common mistakes, you can ensure your checks are filled out correctly every time. Always remember to double-check every portion of your filled check. This meticulousness not only aids in validation but also helps you learn to write checks correctly for various payment scenarios—whether for rent, goods, or salary.

Key Takeaways

- Know the basic components of checks and their purposes.

- Follow clear steps for completing a check to avoid common mistakes.

- Utilize tips for ensuring clarity and cohesion in check filling.

FAQ

1. How do I endorse a check?

To endorse a check, turn it over and sign your name on the back, usually on the designated line. Sometimes, additional information like account details or ‘for deposit only’ may help expedite the transaction. Ensure clear writing for prompt processing.

2. What if I’ve made a mistake on a check?

In case of a mistake, do not attempt to erase it; instead, write “VOID” across the front and start a new check. This practice avoids confusion and maintains clarity, which is critical for bank processing.

3. What are digital checks?

Digital checks refer to electronic methods of issuing and receiving checks using online banking systems. This makes transactions faster and safer, utilizing encryption and verification methods for enhanced security.

4. Can you cash a check without a signature?

No, check validation requires the payee’s signature. Without it, the check is considered invalid. Ensure you or your authorized signor sign all checks to facilitate the cashing or depositing process smoothly.

5. Are there limits on checks I can write?

While there are no strict limitations on check amounts, banks may flag transactions exceeding normal thresholds for suspicious activities. It’s advisable to check your bank’s policies regarding check amounts beforehand.